How to Choose the Right POS System for Business

With so many point-of-sale systems currently available in the marketplace, it may be hard to figure out how to choose. Selecting a POS system for your business is not a decision you should take lightly. After all, the lifeblood of your business is sales, and your goal should be to acquire the best point-of-sale system to accept payments from your customers.

Not all POS systems are created equal, and not all businesses require systems with features they are never likely to use. For example, the ability to track inventory for a service-based business is usually not required, nor is the ability to invoice customers for a purely retail-based business. Once you know what features you need to run your business most effectively, you need to perform a point-of-sale system comparison to find the right one for you and avoid potentially expensive pitfalls.

Here are some of the things to avoid.

POS Systems Built By or Locked to a Specific Merchant Processor

While many point-of-sale systems want you to use a specific merchant processor to handle your payments, some companies will require you to. Practices such as this purposely blur the lines between a point-of-sale system provider and a merchant processor to acquire more revenue. Here are some issues you can expect to see when performing point-of-sale comparisons.

- No Competition. The POS provider includes expected revenue from credit card processing fees in their business model. Removing the possibility of competition integrating into their POS almost guarantees you will not receive the best POS system rates on the market. While the cost of the POS may seem tempting, when you factor in the processing fees, the POS can become very expensive. We have some specific examples of these situations where we discuss POS providers later in this article.

- No Processing-Rate Guarantees. It is common for point-of-sale systems to sign exclusive deals with processors if they aren’t one themselves, and once their portfolio grows, they sell them directly to the processor. Because they do not guarantee rates for any period, the purchaser of said portfolios will raise rates immediately following their acquisition to hasten their profitability. The overall goal is to get merchants to rely on their point-of-sale system and non-competitive processing fees to make it difficult to switch to another processor. Changing POS systems is a huge hassle, and companies like to take advantage of this. Some POS providers deploy as many pieces of equipment as possible, knowing they will become very profitable once they start increasing rates in the future. A perfect example of this tactic is Square.

- Contracts. After you learn how to choose a point-of-sale system, you will discover that systems frequently come with contract terms from 1-3 years with auto-renewals. POS providers purposely lock you into a contract to guarantee cash flow for years, which can be a costly mistake for your business. Unless you have limited options and require specific functions that only these POS systems provide, avoid non-cancellable contracts at all costs.

POS Systems that Require Contracts with Cancellation Fees

Whether you can or cannot use your own merchant processing company to get the best point-of-sale rates, POS providers commonly charge a monthly fee for using their systems. If the point-of-sale system is wrong for your business and you are contractually obligated to make payments for a year or more, it will not be worth it. Contracts exist to dissuade you from switching POS providers.

Avoid contractual obligations wherever possible and only work with companies that allow you to leave, without penalty, the moment you no longer feel they are a fit with your business. While avoiding point-of-sale system exclusivity agreements and non-cancellable contracts are good business decisions, you should expect the following when performing point-of-sale comparisons.

Monthly Fees While Using the POS System

Some POS providers will give you their point-of-sale system hardware for free upfront, and you may pay them a monthly “rental” or “lease” payment. Others may charge you for the equipment AND a monthly fee on top. These fees depend on the POS system and can range from $50 to $500 per month. Be sure to pay close attention to the terms of any contract you sign and how long your business is obligated to pay these fees. If you stop using the system, there should be no more monthly fees.

Upfront Purchase of Equipment

POS system manufacturers frequently charge for all hardware as part of their business practice. Be mindful that POS systems can range from $1,000 to $60,000+. The cost will depend on the POS system your business needs for daily operations, and typically the more features and complexity, the higher the costs.

Service Contracts

Some of the larger POS systems require service contracts. If you ever need support for their hardware, you will need to have a service contract in place so you can call and get technical support. While this may seem unreasonable on the surface, some systems require a lot of integration with an internet service provider, and the processor is typically the primary contact for the merchant’s entire internet infrastructure. Again, this is usually for enterprise-level merchants.

To help you figure out how to choose a point-of-sale system, we listed a few case studies on some of the most popular POS providers below.

Case Studies

Company: Toast

Rating: ![]()

Pros: Good Features

Cons: Contractual Obligation, Processor Locked, High Processing Fees, Rate Changes

Source: Toast Merchant Agreement

Toast is an all-in-one point-of-sale system that caters to restaurants specifically. The system is quite robust and offers a lot of features.

We don’t want to go into what the Toast POS can or cannot do because it is up to the merchant to know how to choose a point-of-sale system and decide what is best for their business POS functions. In this analysis, we want to focus on what the POS will actually cost a merchant to use and what could potentially go wrong.

Contractual Obligation – Toast requires a 1-3 year contract (usually three years) with hefty early termination fees that equal the total cost of the hardware provided to the merchant plus all of the income they would have earned from the merchant throughout the ENTIRE agreement.

For example, if a merchant uses hardware that costs $200 monthly, that’s a termination fee of $7200 PLUS the lost profit on the processing fees. If your business does $50,000 a month and Toast earns a profit of $385 (.77 %, see below) a month on the processing, that can add $13,860 and bring the total early termination fee to $21,060. Believe it or not, this is a cheap example. When obtaining a quote from Toast, multiply your monthly obligation by the term of the agreement in months to get the cancellation fee on their monthly equipment fees.

Processor Locked – Toast has a partnership with Vantiv and locks their POS for exclusive usage through their ISO agreement so they earn all of the processing profit. The bottom line is no other processor can integrate with Toast, and you are locked into whatever merchant processing rates initially provided, which we found are very expensive.

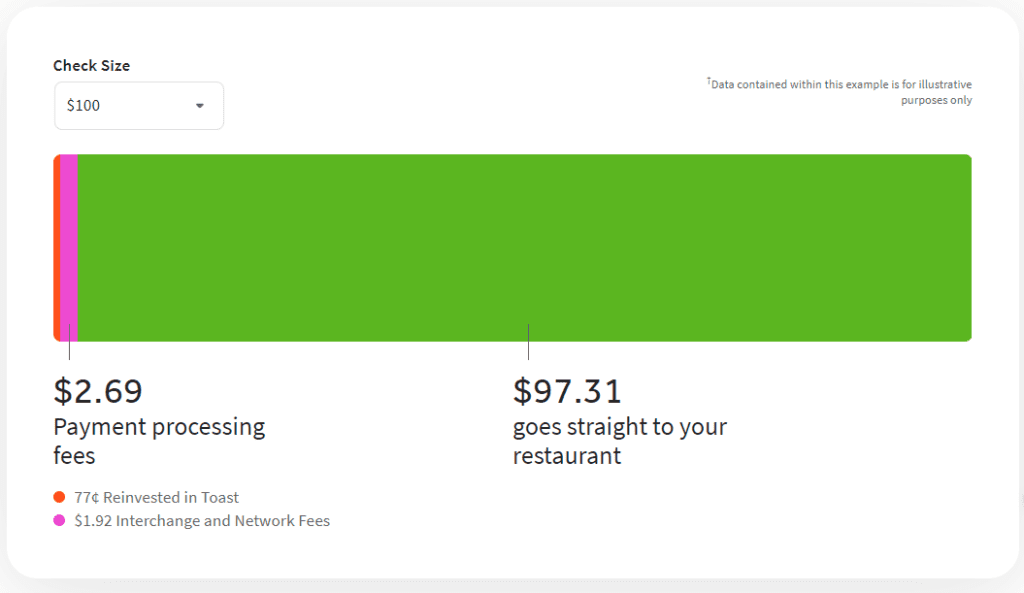

High Processing Fees – As expected, with long contract terms and a locked system, Toast’s processing fees are not competitive in point-of-sale comparisons with the rest of the merchant processing market. On their website, they give an example of a typical transaction.

This example assumes you will pay 2.69% for a swiped transaction of $100, which is $0.77 of profit to Toast that they elegantly call “Reinvested in Toast.” On the surface, 77 basis points are expensive as it is. However, this also assumes that the Interchange (Hard Cost) transaction rate is 1.92%. There are many situations where this would be a much worse deal. For example, when a merchant accepts a regulated debit card, the Interchange cost is only .05% + $0.22, which would be a cost of only $0.27. That would mean that Toast makes a whopping 2.42% profit! If you’re curious about the math, read more about how pricing works.

Card-not-present transactions are 3.50%, according to several quotes acquired from Toast’s sales department. While Interchange is more expensive on keyed sales, there is still a LOT of profit with these spreads.

Toast does offer to “Meet or Beat” rate proposals from other merchant processors, but Toast’s ability to change rates whenever they want confirms that they will never provide the best point-of-sale transaction rates.

Rate Changes – Toast reserves the right to change any fees and processing rates with a 30-day written notice. While they allow you to cancel your service without any termination fees, if you object to rate hikes, you have to do so in writing before the effective date of the change (30 days from notice). So, be on top of each notice Toast sends you and prepare for rate increases that do not have limits. If you object to the higher rate, you will have to scramble to implement a new point-of-sale system into your business, which is what Toast wants. The goal is to keep charging you high rates, and if you do not know how to choose a point-of-sale system, competitors will not be an issue for them.

Good Features – Toast has a ton of features built specifically for restaurants. Pay at the table has become popular because you can accept a tip at the time of the sale. There are some ramifications on Interchange costs. Since the tip runs at the time of the transaction, another adjustment for a higher amount than was initially authorized is not required, and you can avoid potential downgrades to higher Interchange categories.

While Toast may be a great point-of-sale system in function (or so we hear), it is a terrible option based purely on having complete control of your payment system. Processing rates are non-competitive and can change at any time. You are contractually obligated to work with them for long periods or face hefty termination fees, and you are not able to use any processors that may be much cheaper. Bundling a POS system with a processing solution is sold to merchants as a simple solution that you can implement quickly. But if you perform a point-of-sale comparison, it will reveal that this company is out to collect as much revenue as possible.

Consider these things carefully before working with Toast, and check out their rates and fees before making a decision.

Company: Square

Rating: ![]()

Pros: No Contract, No Monthly Fees, Great Features

Cons: High Fees (Sometimes), Processor Locked, Rate Changes

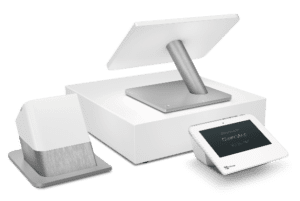

Square is a market leader in merchant processing and quality point-of-sale systems. The hardware looks clean and gives a professional appearance to a business. It also speeds up customer interactions and increases revenue by allowing customers to tip on transactions where they would not under normal circumstances, such as for take-out restaurants. While Square is an excellent option for some merchants, it may not be the best point-of-sale system for others.

Square is a payment processor as well as a point-of-sale system manufacturer. They operate as what is known as a payment aggregator, with all transactions flowing through one centralized merchant account rather than each merchant having their merchant identification number (MID).

Paypal is another well-known payment aggregator. While there are benefits to working with a payment aggregator that offers fast and easy setup and transparent pricing, there are also drawbacks. Paypal is known to close merchant accounts and hold user funds if they deem your business too high-risk. While most merchant processing companies can do this, our point-of-sale comparison found that Paypal is usually more aggressive in shutting accounts down Because Square functions similarly, they could be problematic for high-risk business categories.

Here are some important considerations to keep in mind.

Processor Locked – Square is a merchant processing aggregator and only allows you to process through them if you use their point-of-sale system.

High Fees (Sometimes) – Square’s current pricing, as indicated on their website at the time of this publication, is 2.60% + $0.10 per transaction for card-present transactions and 3.50% + $0.15 for keyed-in transactions. There is also a fee for their point-of-sale register, either a $799 purchase or $39 per month for 24 months.

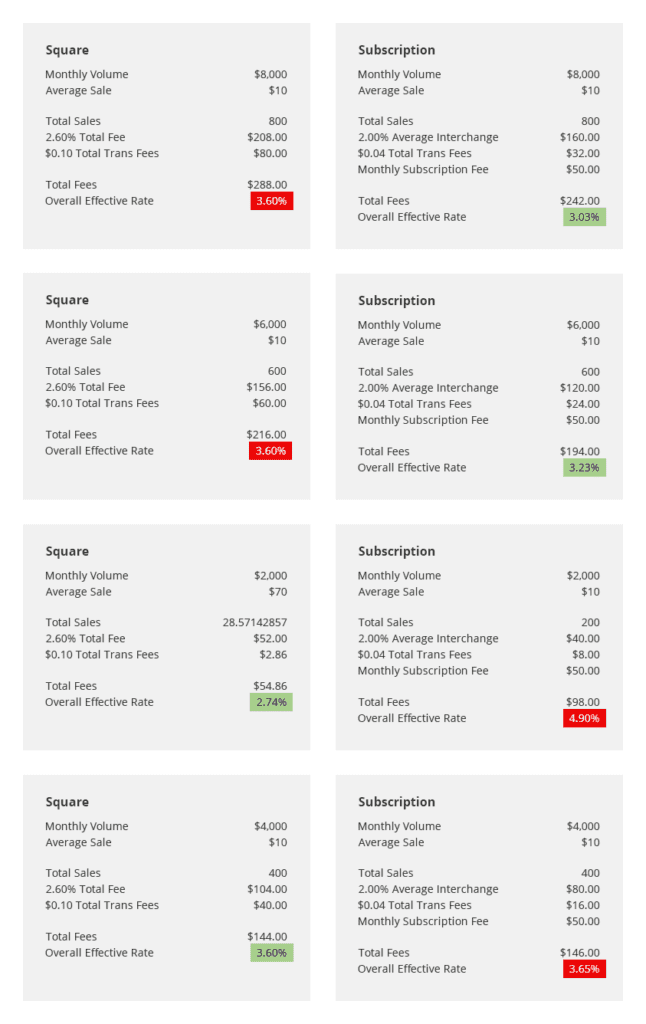

While the cost for the register is reasonable, the processing rates may or may not be. It depends on your average sale (ticket) and average monthly volume. Square does not charge any monthly fees, which can make a big difference compared to traditional processing accounts. Here is an example of Square’s pricing versus our subscription-based pricing.

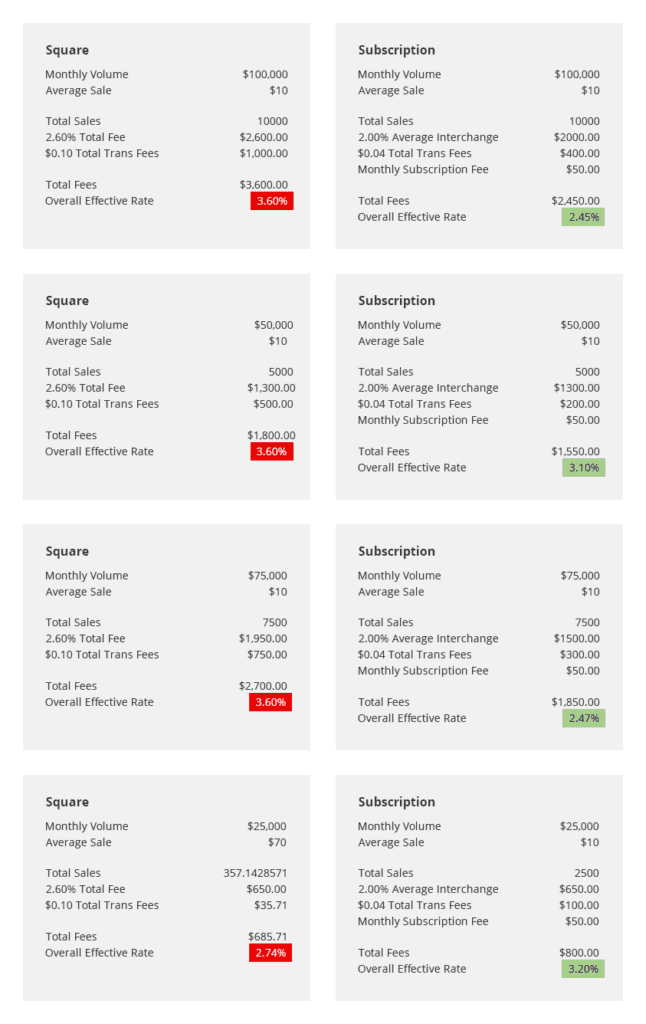

As you can see from these pricing examples, it takes some math to figure out what works out best for a merchant when the monthly volume is on the lower side. The difference is not usually substantial unless the monthly volume drops significantly. However, as monthly volume increases, the pricing difference becomes sizable, and subscription-based pricing is hands-down cheaper.

As merchant volume grows, the difference in rates becomes very apparent.

Rate Changes – There was a time when Square was much cheaper than it is today. On November 1st, 2019, Square updated its swiped rate from 2.75% to 2.60% + $0.10. This change had a huge impact on merchants, especially business owners that have low average tickets. If the average ticket is below $70, these pricing updates increase fees for merchants.

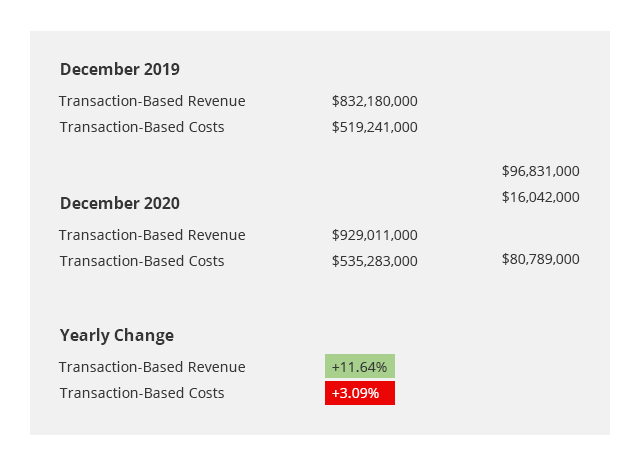

By adding a transaction fee, Square significantly increased its profitability on small merchants. It is difficult to assess how much of an impact this made by looking at Square’s quarterly report since they made changes one month before the earnings report was released and right before a major holiday (Christmas). However, we can compare from one year to the next using transaction-based revenue and transaction-based costs.

Square’s transaction-based revenue jumped up 11.64%, while their transaction-based costs only increased by 3.09%, netting a difference of roughly $80 million for just one quarter!

When researching how to choose a point-of-sale system, consider whether or not a processor has the ability to change your rates in the future. It makes a big difference.

No Contract, No Monthly Fees, Great Features – Square does not require contracts if you finance the system with a monthly fee, but some terms and conditions may apply regarding that financing agreement. There are no monthly fees you need to be concerned with, which was great when the rates were a flat 2.75%. And while their new rates are not as competitive, you do not pay a dime until you make a sale.

Square also features an application marketplace that lets you download apps that provide features such as auto-tip-distribution software, analytics tools, and even industry-specific POS applications for restaurants, healthcare, and insurance businesses.

According to our comparisons, Square may not be the best point-of-sale system. But it is a good option for merchants that process less than $7,500 a month in revenue and are looking for sleek and well-designed equipment. Square can be tailored to almost any business type and gives merchants analytic tools regular credit card terminals will not.

Company: Clover

Rating: ![]()

Pros: Low Fees, No Contract, Great Features

Cons: Platform Locked

Clover is one of the most popular point-of-sale systems in the market today. They tailor payment systems to almost every business type and have a professional and sleek appearance. Furthermore, they have a customer-facing display that allows transactions to be processed efficiently and rapidly. Some important considerations for the Clover system include:

Platform Locked – First Data developed the Clover system, and Clover will only work on the First Data platform. The good news is that most processors use the First Data platform, so you have a wide selection of processors to choose who can give you what you need. If you know how to choose a point-of-sale system, this isn’t the best situation, but it is far from the worst. Chances are pretty good that whoever you decide to process payments with will be on First Data anyway.

Only the processor you purchase the system from has the authority to program Clover. So if you decide to change processors, you will have to get another Clover system from the new processor. In this regard, Clover is very similar to a standard credit card terminal.

Low Fees – Since many processors can use Clover, there is a lot of competition which is great for merchants as it drives down prices. We label this section “low fees” because Clover is the preferred point-of-sale system, and Synapse’s fees are the lowest in the industry. You can pay high rates at other processors while using the Clover POS system, but it is not a guarantee the way it is with systems like Toast.

Fiserv charges a monthly fee for the POS system, and the type of equipment used determines how much. Currently, the cost of using one register is $44.95 per month. The Clover system is the most cost-effective POS system and does not require processing agreements that are inescapable without paying exorbitant cancellation fees. Pricing is negotiable, and many processors are ready to serve your business.

No Contract – While the Clover system does not require a contract, the processor you decide to work with may do so. Since any processor that works with First Data can use Clover, it is critical to perform point-of-sale comparisons and inquire about contract terms with any prospective processing company. At Synapse, we do not contractually obligate our clients to work with us at any time.

Great Features – The Clover system has everything you need to run a successful business. It has a very sleek and professional design, and it makes it very easy to handle a lot of customers quickly and efficiently.

Clover also has an application marketplace that allows you to download apps you may want to utilize. For example, it has analytics tools, payroll tracking apps, time clock apps for employee tracking, and even industry-specific applications such as FlexWash for car washes and Clover Dining made for restaurants.

As a result, we believe Clover is the best point-of-sale system because you can choose your merchant processor and customize the system to do what you need. You get the benefit of low processing fees, and most likely, you will not have to sign a long-term contract.

Still have questions? Get in touch! We compare point-of-sale systems every day, and we’re happy to help you choose the best one for your business.